Housing Loan - HDB Housing Loan

1. Eligibility for HDB Housing Lan (HLE). '' Who can apply housing loan from HDB? ''

2. Requirement for taking 2nd HDB Housing Loan (HLE). '' What you need to know if you applying HLE for the 2nd time?''

3. Calculation for Housing Loan (HDB flat) - HLE/ Bank Loan. '' How much you can loan from HDB/ Bank? ''

4. Calculation for Housing Loan (Private Residential) - Bank Loan. '' How much you can loan from Bank? ''

Eligibility for HDB Housing Loan - HLE

You can apply for HDB housing loan if you and your essential occupiers meet ALL these conditions.

» At least one buyer is a Singapore Citizen

» Never taken any HDB housing loan before / taken once only

» Gross monthly income does not exceed $12,000 for families, $6,000 for single buyer who buy 5-room or smaller resale HDB flat

» Must not own or have disposed any private residential property 30 months before the date of application for HLE letter

» Remaining lease for the HDB flat must have 60 years or more

* Click here to see if remaining lease of the HDB flat is less than 60 years. Loan amount might reduced / not able to loan from HDB

Requirement for taking 2nd HDB Housing Loan - HLE

» You have to use FULL CPF proceed from the sale of your current HDB flat to your next flat.

» You may keep $25,000 or half of the cash proceeds (whichever higher) from the sale of your current HDB flat.

*HDB will take into account the remaining part of the cash proceed when determining the amount of the 2nd loan to be granted to you.

Example 1: Your cash proceeds from the sale of your current HDB is S$30,000, which means you can keep S$25,000.

Example 2: Your cash proceeds from the sale of your current HDB is S$60,000, which means you can keep S$30,000.

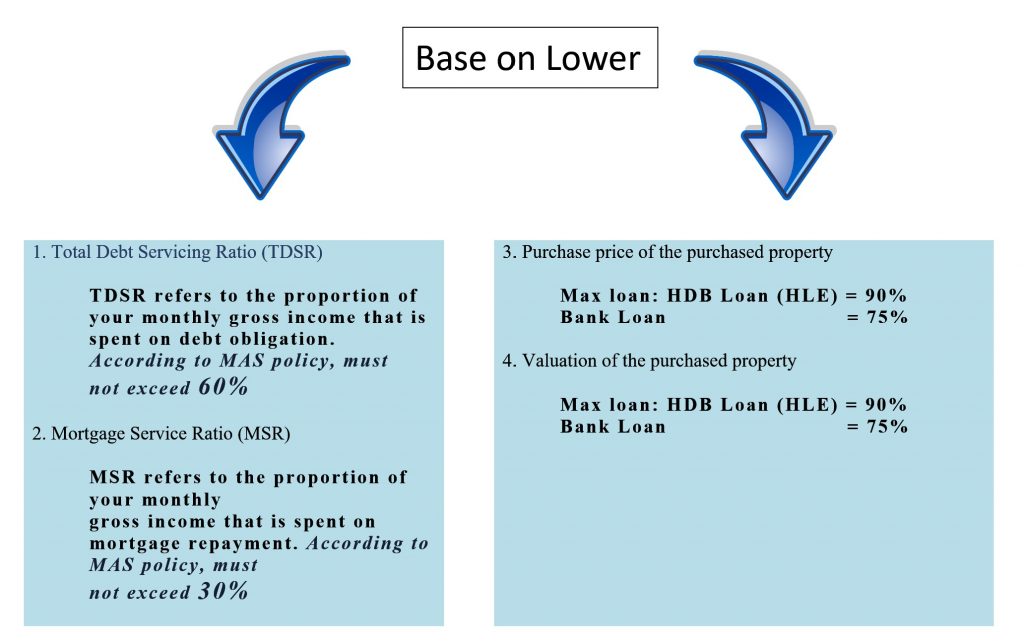

Calculation for Housing Loan - HDB Flat

There are 4 factors that HDB will take into consideration when buyers apply for the housing loan, either HLE /Bank loan.

Approval of the loan amount will be calculate based lowest amount among these 4 calculations.

For HLE (updated on 10 May 2019): If the remaining lease of the flat cannot cover the youngest buyer to the age of 95, they can still take an HDB loan but the LTV limit will be pro-rated from 90%, based on the extent that the remaining lease can cover the youngest buyer to the age of 95.

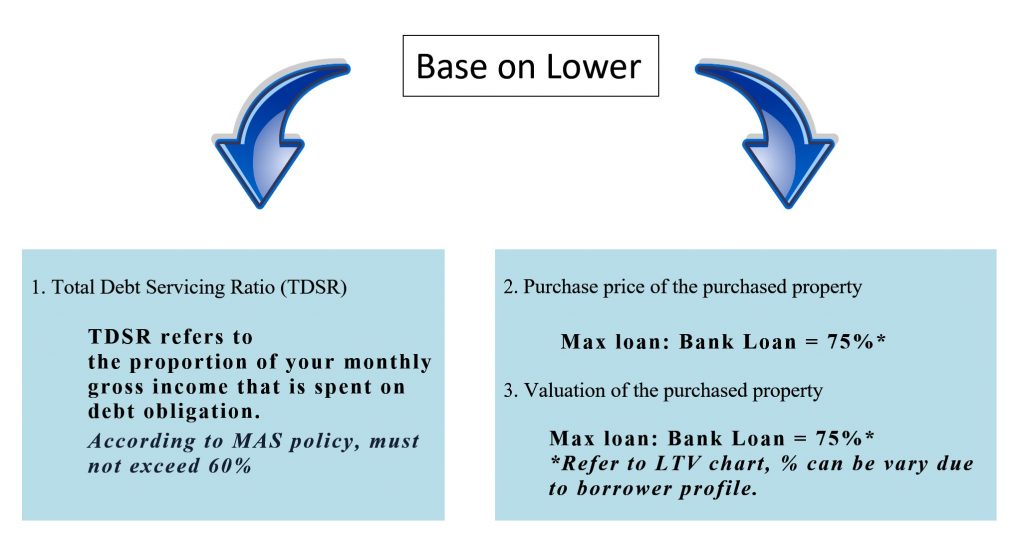

Calculation for Housing Loan - Private Residential

There are 3 factors that bank will take into consideration when buyers apply for the housing loan.

Approval of the loan amount will be calculate based lowest amount.

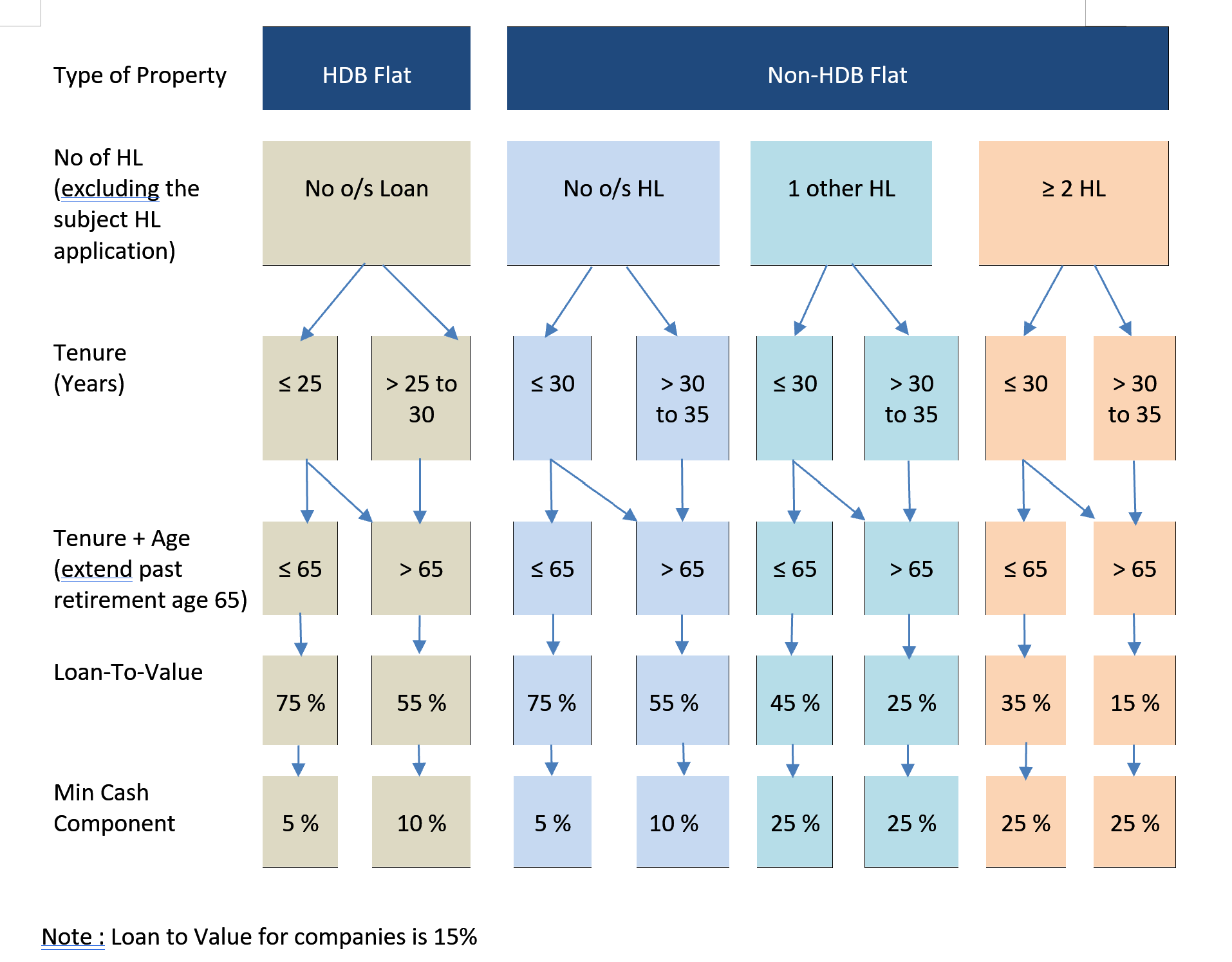

LTV, Tenure & Min Cash Down payment for property purchase